When most people think about the difference between accounting and bookkeeping, they are confused about the distinction between each process. Although accountants and bookkeepers share similarities, they are used in your business at different stages of the financial cycle.

In short, accounting is more about analytics in that it gives you strategic insights into your business’s financial health based on bookkeeping data. Conversely, bookkeeping is an administrative task that’s concerned with accurately recording financial transactions.

In this short guide, we will cover the functional differences between accounting and bookkeeping.

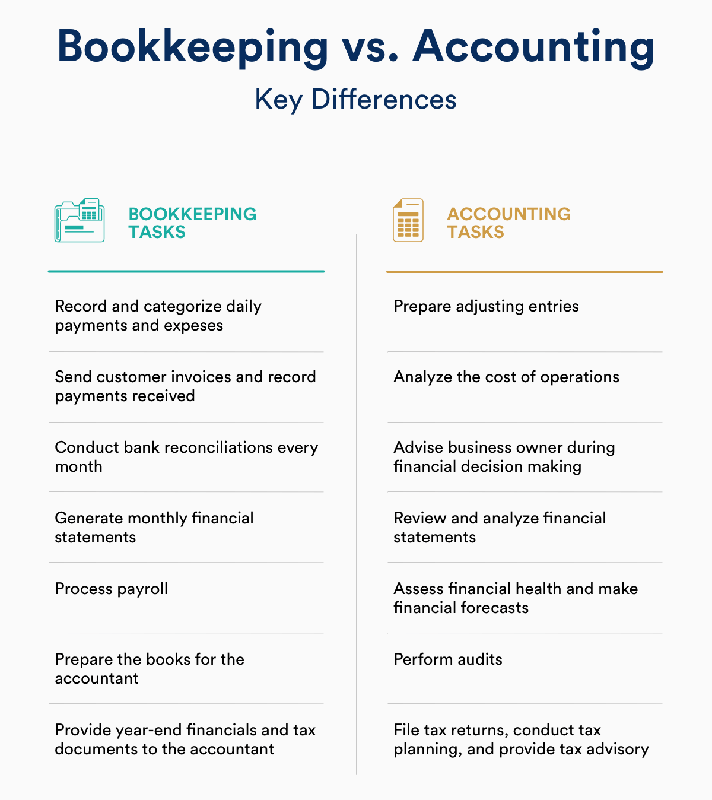

Key Differences Between Accounting and Bookkeeping

The Function Of Accounting

Accounting is a term used to describe a high-level process which uses financial data assembled by a business owner or bookkeeper to generate financial models. The consolidated information is made more clearer for all to understand.

Whereas the bookkeeping process is more transactional, the accounting process is more subjective.

The accounting process consist of:

- Analyzing costs of operations

- Completing income tax returns

- Reviewing company financial statements

- Aiding the business owner in understanding the impact of financial decisions

- Preparing entry adjustments

The Function Of Bookkeeping

Bookkeeping entails recording transactions in a consistent way on a daily basis. It is a key component in collecting the financial information necessary to run a successful business.

Details of bookkeeping includes:

- Completing payroll

- Preparing financial statements

- Creating invoices

- Posting debits and credits

- Recording financial transactions

- Balancing and maintaining historical accounts, subsidiaries, and general ledgers

Conclusion

We hope this article has been helpful in understanding the difference between accounting and bookkeeping. It’s a fact that the long-term success of every business is related to properly balanced financial statements and organized financial records. Some business owners learn to manage their finances on their own. But others choose to hire a professional so that they can focus on parts of their business that they prefer doing. In either case, your business financials will significantly help your business grow.

You may also enjoy reading: Do You Pay Taxes When You Sell Your House?