It can be a bit confusing when it comes to writing off meals and entertainment deductions for your small business in 2024. Getting acquainted with what used to be 100 percent deductible and is now 50 percent deductible will take time. So, it will all depend on who benefits from it and the purpose of the event or meal.

In general, freelancers and small businesses alike are not sure what constitutes as a business meal. The fact is, all types of business; salespeople, self-employed, consultants, as well as small business owners should be claiming business lunches.

But again, it’s knowing what counts. In this mini guide, we’ll explore meals and entertainment deductions as the rules stand for 2024. What to claim, and some things to avoid.

And if you need a bookkeeper (and tax expert) to guide you through some of this, check out The Ray Group.

Meals and Entertainment Deductions In 2024

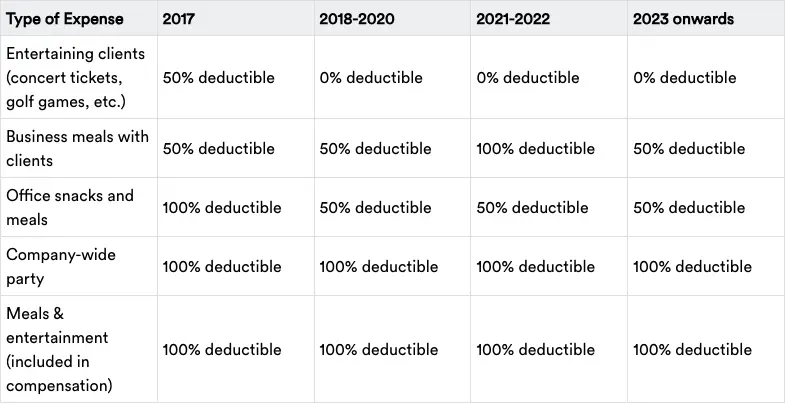

The deductibility of meals is changing as part of the Consolidated Appropriations Act signed into law December 2020. If purchased from a restaurant, food and beverages were 100% deductible in 2021 and 2022.

But the rules revert back to how they were defined in the Tax Cuts and Jobs Act for purchases made in 2023 onwards. So, what does that mean? It means the 100% deductible no longer applies to purchases at restaurants.

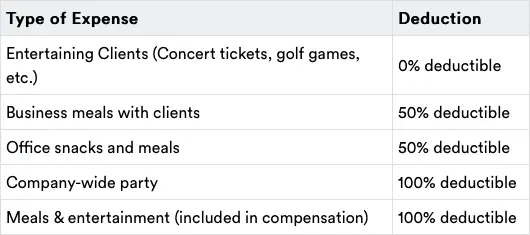

Here’s a breakdown of meals and entertainment deductions for 2024 using examples:

Which Meals and Events Are Now Fully Deductible?

Here are some common examples of 100% deductible entertainment and meal expenses:

- Food or drinks provided for the public that are free of charge.

- A company-wide holiday party.

- Food included on W-2s that are provided to employees as taxable compensation.

50% Deductible Expenses

The following expenses are examples of 50% deductibles:

- Employee meals while traveling.

- Dinner provided for employees while working late.

- Employee meals that are above and beyond the ticket price at a conference.

- Food for a board meeting.

- A meal with a client where work is discussed.

Entertainment Tax Deductions

The deductions amounts have changed from previous years for meals and entertainment. One of the biggest changes is that entertainment expenses are no longer deductible. However, some things have not changed.

Check out the summary table below of popular deductions as compared to what they were in 2017.

So, What’s Nondeductible?

While most work related meal purchases are either 100 or 50 percent deductible, there are exceptions. For example, not going to a client’s night out that you paid for, is not deductible. As for restaurant meals. If you invite family and friends to a client meal, you can only deduct half the client’s bill.

You may also enjoy reading: 2024 Deadlines For Corporate Taxes