Staying compliant with payroll and contractor reporting is a must for every business, and 2026 brings several updates employers and freelancers should prepare for. This 2026 payroll and tax guide breaks down what’s changing, what stays the same, and how to avoid costly penalties as you head into the new tax year.

These resources provide guidance on submitting your 1099 information to us, as well as changes in State Disability Insurance rates, CalSavers, FUTA, and more. Let’s get you prepared for the upcoming year.

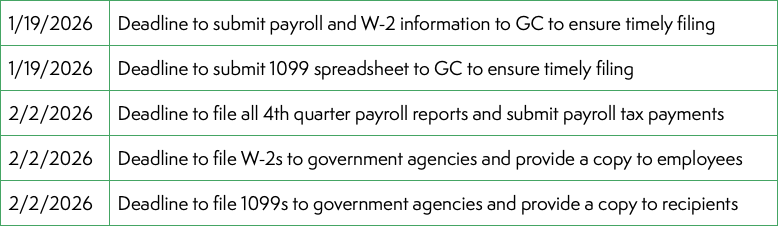

Deadlines for Year-End 2025

2026 Payroll and 1099 Guide – Understanding the Forms

Form 1099 is used to report payments made to non-employees. If your business paid $600 or more to a qualifying contractor during the year, you’ll likely need to file a 1099.

Common 1099 Forms for 2026

- NEC – Payments to independent contractors and freelancers

- MISC – Rents, royalties, prizes, and certain other income

- K – Payments processed through third-party platforms (subject to IRS thresholds)

Important: Worker classification remains a major IRS focus. Misclassifying employees as contractors can result in back taxes, penalties, and interest.

Key Payroll Requirements for 2026

Payroll applies to employees and involves withholding and remitting taxes on their behalf.

- Payroll Basics Employers Must Follow

- Withhold federal income tax, Social Security, and Medicare

- Pay the employer portion of Social Security and Medicare

- Pay federal and state unemployment taxes

- Issue Form W-2 to employees by the annual deadline

In 2026, employers should continue monitoring federal and state changes to tax rates, wage bases, and minimum wage laws, as these can shift annually. Don’t forget about the One Big Beautiful Bill. It requires reporting of tips and overtime for certain industries. The IRS has released a draft 2026 W-2. And the important step for 2026 is to begin tracking all overtime and tips with the first paycheck if this applies to your industry.

New and Ongoing Compliance Considerations

This 2026 1099 and Payroll Guide wouldn’t be complete without addressing compliance trends.

What Businesses Should Watch

- Increased IRS enforcement on worker classification

- Expanded electronic filing requirements

- State-level reporting rules that differ from federal standards

- Local payroll taxes in certain cities and counties

Businesses operating in multiple states should pay special attention to nexus rules and state-specific payroll obligations.

Best Practices for 2026 Payroll and 1099 Reporting

To stay compliant and reduce errors, consider these best practices:

- Collect W-9 forms from contractors before issuing payment

- Use payroll or accounting software that supports 2026 updates

- Reconcile payroll records quarterly, not just at year-end

- Keep documentation for at least four years

- Consult a tax professional if your workforce structure changes

Being proactive is far cheaper than fixing mistakes later.

Get in Touch

Our Client Accounting Services team is happy to answer any questions. We hope this mini 2026 payroll and 1099 guide help you get off to the right start. Thank you for putting your trust in our team, and please don’t hesitate to contact us for assistance. Here’s to another year of partnership, and a Happy 2026!

You may also enjoy reading: Farm Succession and Estate Planning